Talk Money Week: 6–10 November 2023

Even with an increase in cost of living-related news, we know it can be hard to talk about money. Every year we host Talk Money Week to encourage people to open up about their finances.

Discover how to get involved in Talk Money Week, regardless of the sector or size of your organisation, and find guides on how to Talk Money with your friends, family or children.

What is Talk Money Week?

The week is an opportunity for everyone to get involved with events and activities across the UK which help people have more open conversations about their money – from pocket money to pensions – and continue these conversations year-round.

We encourage you to use the week as an opportunity to talk about any aspect of money.

Why Talk Money

As we recover from the Covid-19 pandemic and with current cost-of-living pressures, it’s more important than ever that we get support for money worries.

Research shows that people who talk about money:

- make better and less risky financial decisions

- have stronger personal relationships

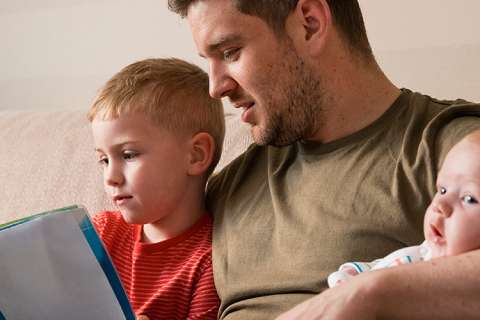

- help their children form good lifetime money habits

- feel less stressed or anxious and more in control.

Building money conversations into our everyday lives also helps us build financial confidence and resilience to face whatever the future throws at us.

Do One Thing

This year, we’re asking stakeholders, partners, organisations and businesses all over the UK to encourage their own audiences to Do One Thing that could help improve their financial wellbeing – and to make a noise about it, to inspire others to do the same.

It doesn’t have to be huge. In fact, it could be as simple as asking them to check the address on their pension, talk to a child about pocket money or use one of the free tools or calculatorsOpens in a new window on the MoneyHelper website.

If you want to talk about financial education – great. Pensions more your thing? Go ahead. All that matters is that we get people talking about money, together.

- Decide on your ‘one thing’

- Tell everyone about it

- Encourage others to do the same!

Download the participation pack

Not sure where to start? Our Talk Money Week 2023 participation pack offers ways to tailor your activities to your sector and audiences.

Use our comms toolkit

Our communications kit includes social media graphics, banners and a poster. There is also template copy for your social media channels, intranet and email newsletters, as well as a form for you to share your Talk Money Week plans.

Download the Toolkit for Schools

This dedicated toolkit for schools includes information and resources to help you promote the financial wellbeing of your pupils and students, during Talk Money Week and beyond.

Contact our Partnerships Team

For support in starting your Talk Money Week journey, contact the Partnerships Manager in your region or nation.

Discover how to get involved in Talk Money Week, wherever you are or whatever your organisation.

Where to Talk Money

Use Talk Money Week to kickstart a conversation in any walk of life, including:

- in your workplace

- with your customers across a range of sectors

- in education

- at home with friends and family.

Talk about money with friends and family

Use our following online guides to help you start conversations about money with your partner, kids, friends, parents and grandparents:

If it’s not safe to talk

If your partner or family controls access to your money, or runs up debts in your name, it’s financial abuse. But there’s no need to struggle on alone.

Read this guide on Financial abuse: spotting the signs and leaving safelyOpens in a new window

Looking for money or pensions help?

MoneyHelper is here to make your money and pension choices clearer.

Here to put you in control with impartial help that’s on your side, backed by government and free to use.